Tuesday, December 27, 2016

Assalamualaikum and very good day.

Last week we saw the CPO price did some bungee jumping (free fall) from its high of 3202 to the lowest of 3014 (support area).

My 1st attempt of buying was shot dead by the angry bear.

This week, I'm looking for another buy (if any).

Will this 2016 end it's December in different fashion compared to past years? who knows.

Wishing you a happy end of year & may the force be with you in 2017.

Happy holiday!

Labels:

#FCPO

Monday, December 12, 2016

Hi all,

I'll combine the Soy Oil/Crude Oil / CPO analysis in 1 post starting from this week.

Hope you don't mind it.

Looking at bigger picture, all of these commodities showing inverted head and shoulder pattern and yet to complete.

Therefore, in my humble opinion, we should channel our trading capital into Long position whenever possible, based on our interpretation to the market.

I'll combine the Soy Oil/Crude Oil / CPO analysis in 1 post starting from this week.

Hope you don't mind it.

Looking at bigger picture, all of these commodities showing inverted head and shoulder pattern and yet to complete.

Therefore, in my humble opinion, we should channel our trading capital into Long position whenever possible, based on our interpretation to the market.

FCPO Daily

Crude Oil Daily

SoyOil Daily

For Class update:-

I'decided not to continue with my plan to conduct class for time being due to restriction on my schedule + ehemehemmmm I'm expecting to receive another family member soon.

So, Lets enjoy the moment that we have for now.

Cheers.

Labels:

#FCPO,

#KelasCPO,

crude oil,

soy oil,

trading soy oil

Monday, November 28, 2016

Salam & Hi,

Attached herewith are analysis on FCPO & Soy Oil.

As seen in the picture, both are in bullish mode since couple of weeks ago. So, for me, I'll wait at support before resume buying again.

Happy trading to all.

SOY OIL

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

#KelasCPO,

soy oil,

trading soy oil

Sunday, November 20, 2016

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

#KelasCPO

Labels:

soy oil,

trading soy oil

Labels:

crude oil,

trading crude oil

Saturday, November 12, 2016

Assalamualaikum & Good day everybody.

As analysed last week, CPO did a shoot up (much faster than I anticipate).

Next week, whether it continue to find another high or not, is still unknown.

With Price moving too fast and too hot, it need to come back to support area before resume.

Therefore, keep your calm and patient.

Wait at support area and wait for the trigger to surface itself.

Identify your risk & Stop area.

Then, let it go.

No chart for this week.

Malas nak taruk... hehe.

Possible support - 2863; 2903

Happy trading

As analysed last week, CPO did a shoot up (much faster than I anticipate).

Next week, whether it continue to find another high or not, is still unknown.

With Price moving too fast and too hot, it need to come back to support area before resume.

Therefore, keep your calm and patient.

Wait at support area and wait for the trigger to surface itself.

Identify your risk & Stop area.

Then, let it go.

No chart for this week.

Malas nak taruk... hehe.

Possible support - 2863; 2903

Happy trading

Labels:

#FCPO,

#fcpo_analysis,

#KelasCPO

Monday, November 7, 2016

Hi All,

Harami did penetrated on downside last week.

Either it is a false signal or not, is yet to know. For time being, no buy sign seen nearby.

Harami did penetrated on downside last week.

Either it is a false signal or not, is yet to know. For time being, no buy sign seen nearby.

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

#KelasCPO

Sunday, October 30, 2016

Assalamualaikum & very good day.

Last Week Recap.

Price did shoot up as predicted on Monday and start consolidated for the next 4 days last week. (A tough day to trade as it performed as Harami).

Next Week Opportunity.

I want the price to break either upper side or lower side of Harami's mother candle before making any commitment.

On bigger picture, FCPO chart shows us that the inverted HnS pattern is on the card and cannot be taken lightly. I may put bigger weightage on Long opportunity rather than Short opportunity for now on.

Personal Coaching.

Right now, I'm in the midst of coaching 1 guy who lost much in FX due to sudden drop in GBPUSD last 2 weeks. It's hard to re-train person with some experience in market. Hopefully I can make it.

It's not the knowledge that is difficult. It is Habit, discipline and muscle memory that are hard enough to re-develop, re-compose.

Last Week Recap.

Price did shoot up as predicted on Monday and start consolidated for the next 4 days last week. (A tough day to trade as it performed as Harami).

Next Week Opportunity.

I want the price to break either upper side or lower side of Harami's mother candle before making any commitment.

On bigger picture, FCPO chart shows us that the inverted HnS pattern is on the card and cannot be taken lightly. I may put bigger weightage on Long opportunity rather than Short opportunity for now on.

Personal Coaching.

Right now, I'm in the midst of coaching 1 guy who lost much in FX due to sudden drop in GBPUSD last 2 weeks. It's hard to re-train person with some experience in market. Hopefully I can make it.

It's not the knowledge that is difficult. It is Habit, discipline and muscle memory that are hard enough to re-develop, re-compose.

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

#KelasCPO,

FCPO,

FCPO Class

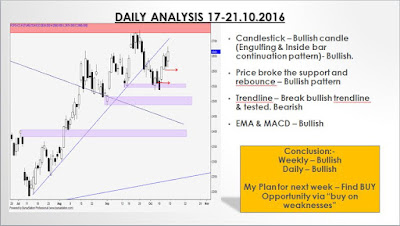

Monday, October 24, 2016

Assalamualaikum & very good day everybody.

Last week, FCPO creates big gap on Monday, followed by bullish candlestick as anticipated. However, once it touched 2800, it did some sharp reversal until Daily candle showed Engulfing pattern and move lower down to 2691 before recover on Friday ends.

Lets take a look on chart for this week. Looks like the signal is mixing (CS vs Others). Either way can be. Chart wise, it is still on Bullish tone.

Last week, FCPO creates big gap on Monday, followed by bullish candlestick as anticipated. However, once it touched 2800, it did some sharp reversal until Daily candle showed Engulfing pattern and move lower down to 2691 before recover on Friday ends.

Lets take a look on chart for this week. Looks like the signal is mixing (CS vs Others). Either way can be. Chart wise, it is still on Bullish tone.

Labels:

#FCPO,

#fcpo_analysis,

#KelasCPO

Saturday, October 15, 2016

Assalamualaikum and Good day fellas.

Last week analysis was short-lived and price started to climb up on Tuesday, hitting our stop loss. (entry was hit below red arrow)

It was proven that Bear failed to punch the bull and surrendered. We did some damage control by reversing the position (according to the trading system) and recoup the losses.

Enough for last week.

Let see what market has to offer for next week.

Last week analysis was short-lived and price started to climb up on Tuesday, hitting our stop loss. (entry was hit below red arrow)

It was proven that Bear failed to punch the bull and surrendered. We did some damage control by reversing the position (according to the trading system) and recoup the losses.

Enough for last week.

Let see what market has to offer for next week.

Weekly

Daily

Potentially, it will test the Red zone again (SoyOil did some push up on Friday night, so expect a gap up on Monday). Do Not rush in following the gap. Relax. Buy on weaknesses, according to the plan.

For me, it is a little bit stress for October, since I increase the lot (double it up) starting this month after the capital growth tremendously since last 3 months. Nevermind. Just follow the plan.

How about you?

Till then, Happy trading. TAYOR.

Labels:

#FCPO,

#fcpo_analysis,

FCPO Class,

Kelas FCPO

Monday, October 10, 2016

Assalamualaikum & very good day fellas.

As anticipated, 3 out of 4 candle last week ended up as a bearish candle.

Lets take a look on FCPO market this week. My take, it may gets some breath before continues it's journey to the south. The barrier it needs to break is support at 2547-2538.

When I try to read the chart - I write it down of what I see. By doing that, at the end of reading - I can summarize it whether it is more towards bearish / bullish. From that point, I need to wait for the trigger to come in and act accordingly.

This approach was first thought to me by Cikgu Khalid Embong or known as Goldfinger in the forum many years ago. When I attend the class conducted by WR (as a refresher) -the same approach was thought there. haha. what a coincidence. Important point is - WRITE IT DOWN!.

So, you choose yourself - your trading strategy must be simple enough for you to trigger. Either you want to trade both direction or waiting for the trigger in the direction you analyse, it is up to you. Either way can make money. Trade wisely.

As anticipated, 3 out of 4 candle last week ended up as a bearish candle.

Lets take a look on FCPO market this week. My take, it may gets some breath before continues it's journey to the south. The barrier it needs to break is support at 2547-2538.

When I try to read the chart - I write it down of what I see. By doing that, at the end of reading - I can summarize it whether it is more towards bearish / bullish. From that point, I need to wait for the trigger to come in and act accordingly.

This approach was first thought to me by Cikgu Khalid Embong or known as Goldfinger in the forum many years ago. When I attend the class conducted by WR (as a refresher) -the same approach was thought there. haha. what a coincidence. Important point is - WRITE IT DOWN!.

So, you choose yourself - your trading strategy must be simple enough for you to trigger. Either you want to trade both direction or waiting for the trigger in the direction you analyse, it is up to you. Either way can make money. Trade wisely.

Weekly

Daily

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

fcpo analysis,

Kelas FCPO

Sunday, October 2, 2016

Wake me up when September ends.

Enjoy the video ya guys.

What I did in September - as per video

OK, lets take a look on September result. Here is the result from 1 of my system (Swing system bujal style).The swing system is running on tf30. It can be run on Daily or Tf 5 or whatever tf you want, depends on your own time and flexibility.

For me, enough on TF30 & Daily.

Lets take a look on next week trading plan. What it has to offer us?

Our primary task as a trader are to make money from market.

Till then, Happy Trading.

Kalau nak jadi student saya, saya akan buka kelas tahun 2017 nanti. Nak ajar 10 orang aje. 1 tahun punya coaching. RM5000 untuk setahun ( RM13 sehari). Kalau dalam masa 1 tahun tu tak boleh paham lagi apa yang saya ajar dan masih tak boleh buat duit dari market, kita pulang balik duit tuisyen tu. Syaratnya, kena siap siap modal untuk trading dalam akaun sendiri (RM15 - 20K). Kami akan ajar anda, sehingga tahap anda boleh beri signal kepada cikgu dan cikgu akan ambil trade berdasarkan signal awak. amacam? Berani? - Fokus adalah kepada market FCPO.

Enjoy the video ya guys.

What I did in September - as per video

OK, lets take a look on September result. Here is the result from 1 of my system (Swing system bujal style).The swing system is running on tf30. It can be run on Daily or Tf 5 or whatever tf you want, depends on your own time and flexibility.

For me, enough on TF30 & Daily.

Lets take a look on next week trading plan. What it has to offer us?

Weekly

Daily

Please do your own due diligence prior taking decision to buy or to sell ya.Our primary task as a trader are to make money from market.

Till then, Happy Trading.

Kalau nak jadi student saya, saya akan buka kelas tahun 2017 nanti. Nak ajar 10 orang aje. 1 tahun punya coaching. RM5000 untuk setahun ( RM13 sehari). Kalau dalam masa 1 tahun tu tak boleh paham lagi apa yang saya ajar dan masih tak boleh buat duit dari market, kita pulang balik duit tuisyen tu. Syaratnya, kena siap siap modal untuk trading dalam akaun sendiri (RM15 - 20K). Kami akan ajar anda, sehingga tahap anda boleh beri signal kepada cikgu dan cikgu akan ambil trade berdasarkan signal awak. amacam? Berani? - Fokus adalah kepada market FCPO.

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

#KelasCPO

Sunday, September 25, 2016

Hi All,

This is latest update on FCPO.

Potentially, there will be more downward movement before resume trending up. I might be wrong. Market is always right. See the market and act accordingly ye.

Last week - on tf30 - We have 4 trades - 4 win

if on tf10 - 13 trades - 5 wins, 8 losses.

This is latest update on FCPO.

Potentially, there will be more downward movement before resume trending up. I might be wrong. Market is always right. See the market and act accordingly ye.

Last week - on tf30 - We have 4 trades - 4 win

if on tf10 - 13 trades - 5 wins, 8 losses.

Labels:

belajar fcpo,

FCPO,

learn fcpo,

trading fcpo

Monday, September 19, 2016

Assalamualaikum & very good day fellas,

Last week trading was not so encouraging as price turned back from its high and went down to 2547 before settling at 2594 for November market.

For those who buy on dips, there was 1 valid entry (on the last day of last week). for buy on breakout - nil.

Lets take a look on potential trade this week.

For me, with new contract (DEC16) coming into continuous chart, it will be little bit tricky on Monday. Let it settle down, and start trade again. My tf of choice is TF30 & Daily. Why? Because I'm part time trader and I don't have much time to glue in front of lappy / pc.

Last week trading was not so encouraging as price turned back from its high and went down to 2547 before settling at 2594 for November market.

For those who buy on dips, there was 1 valid entry (on the last day of last week). for buy on breakout - nil.

Lets take a look on potential trade this week.

For me, with new contract (DEC16) coming into continuous chart, it will be little bit tricky on Monday. Let it settle down, and start trade again. My tf of choice is TF30 & Daily. Why? Because I'm part time trader and I don't have much time to glue in front of lappy / pc.

Labels:

FCPO,

fcpo analysis,

FCPO Class

Saturday, September 10, 2016

At the moment - I didn't follow Crude Oil & Soy Oil too close due to restriction of my time at night (teaching my kids on their study & homeworks; playing with my other 2 kids which are below 5years old).

However, let's take a glance on what the chart trying to tell us.

However, let's take a glance on what the chart trying to tell us.

This is crude chart.As we can see, it did breaks the last defense of bear sometime in August and test the fibo 61%. Currently, we see the engulfing bear candle appears last Friday. 50-50.

My guess......as long as 61% holds, I want to find BUY Opportunity.

Soy Oil - same pattern as Crude Oil. Last defense of Bear had been broken. (Demand >Supply).

Right now, price is in consolidation. Let's see if the price could move higher to FE 100% or more.

Soy Oil & FCPO travel on the same path. One goes up, the other one will follows. Vice versa.

OK that's all from me.

Labels:

crude oil,

soy oil,

trading crude oil,

trading soy oil

Assalamualaikum & Good day fellas.

First of all, thanks for supporting this blog.

As per last week analysis, FCPO did shoot up on Monday, before retrace back to 2588. The entries for BUY on Weaknesses were around 2600-2610

For next week, we will only have 3 trading days as 12/9 & 16/9 will be holiday in Malaysia (Raya Haji & Malaysia Day)

My eyes saw that it will test red zone resistance next week and following weeks. Expect some differences in continuous chart due to change of contract month (November to December).

Happy Holiday & Happy trading.

First of all, thanks for supporting this blog.

As per last week analysis, FCPO did shoot up on Monday, before retrace back to 2588. The entries for BUY on Weaknesses were around 2600-2610

For next week, we will only have 3 trading days as 12/9 & 16/9 will be holiday in Malaysia (Raya Haji & Malaysia Day)

My eyes saw that it will test red zone resistance next week and following weeks. Expect some differences in continuous chart due to change of contract month (November to December).

Happy Holiday & Happy trading.

My 2017 plan - To coach 10 traders (10 and only 10) to become consistently profitable traders. 1 year coaching programme (Classs & Signal Discussion). Fee based coaching. Yup. No more Freebies.

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

FCPO,

FCPO Class

Saturday, September 3, 2016

Assalamualaikum & very good day fellas.

Hope you enjoy the southern train that ends at 2487 (38% fibo).

Let's take a look on what is there facing us next week.

Analysis will be based on SBR/RBS (S = Support; R= Resistance; B= become); SND ; Simple Candlestick; Trendline and a few indicators of my choices.

Weekly Chart

Daily Chart

Question for this week- for readers

1. When do you change fibonacci reading (i.e 0% at top to 0% at below)

When you know this, and you have standard SOP of when you need to flip it, you will find that fibo is quite simple.

Disclaimer - I'm not good in counting EW. I Swing the trade using my own approach and strategy.

Labels:

#FCPO,

#fcpo_analysis,

#KelasCPO,

learn fcpo

Sunday, August 21, 2016

Hi everyone,

Lets take a look on weekly & daily chart of FCPO (future crude palm oil)

Weekly -

CS pattern - long upper shadow - potential pullback- bearish.

Trendline - Breakout of bearish trendline - bullish

Structure - yet to break last LH.- maintain bearish

Daily-

CS pattern - Harami at resistance - potential going lower.- Bearish

Trendline - Breakout of bearish trendline - Bullish

Structure - making HH. if break 2530, then 'Low' is established.

At the moment, price stops at 2580, with resistance at 2650-2680 area.

My opinion, for price to further up, they need to break 2680 area. My guess, it will try to find footprint at minimum 38% fiboa area or deeper. who knows. Trade what we see OK.

Daily Chart

Weekly Chart

Below is the trade table for year 2016 (updated up to August 2016). Purely Daily chart only. I trade tf30 chart and tf daily chart (separate account).

Labels:

#FCPO,

#fcpo_analysis,

#FCPOCLASS,

FCPO,

FCPO Class,

Kelas FCPO

Saturday, August 13, 2016

Assalamualaikum & Good day to all.

Weekly time frame

Daily time frame

Looking back last week - 8-12th August 2016, Price managed to break LH of 2404 thus, confirming the uptrend. Quite pretty easy for those who are in Bull camp to score points after points right?

Lets have a look on the analysis for next week trading.

1. We have end of contract day on 15th. for active contract (3rd month contract).

2, Difference price of Oct contract and Nov contract is 30pts.

3. All indicators right now showing Buying signal.

4. Price might test 2577 this week and turns back to support area (who knows hehe)

5. Candlestick - all from Weekly & Daily is showing solid Bullish.

6. Trendline - Testing for 4 times this week. Next week potentially, it will break and need some healthy testing, before resume uptrend.

Ok. that is what I observed from the chart. What about you? Feel free to comment.

Next year, I'll open the slot for 10 students to learn & trade together using my approach to the trade - not gluing in front of laptop.

Yup. only for 10 person.

12month learning period,

trading together (alert via whatsapp/telegram),

learning fee become trading capital. Is that satisfy your need?

Labels:

#FCPO,

#fcpo_analysis,

learn fcpo

Sunday, August 7, 2016

Sorry for not updating here regularly. With the new technology of Telegram, I frequently update the trade progress there with my trading partners (my students).

Nevertheless, here you are. Latest update on FCPO market

Daily Chart FCPO

- Market Structure - Daily. Breaks last LH. (Bull bias)

- Resistance 2404 become support now.

- Potential pullback before resume trending up?

- EMA trendline sloping up (bull bias)

Weekly Chart

- Structure - still Bearish with potential pullback to fibo area 61%

- Candlestick - Bullish- remain bullish until bearish candlestick engulf the whole scenario for us to reverse.

- Next resistance area (immediate) at 2470-2490

Happy trading. Happy hunting. Good Luck.

Ma

Labels:

#FCPO

Sunday, February 21, 2016

Lets see where the FCPO price will be heading this week (22-26 Feb 2016)

From my analysis, the probability is to pullback to the previously resistance that has become support.

Please do your own analysis before taking any position.

Labels:

FCPO,

learn fcpo,

trading fcpo

Tuesday, February 16, 2016

Assalamualaikum and Good Day everybody.

1. 15.2.2016 - Last day for April Contract FCPO. Next active contract month is May.

2. ITS reported that export for 1-15 Feb 2016 was down by (16.11%) compared to 1-15 Jan 2016.

3. SGS reported that export for 1-15 Feb 2016 was down (14.16%)

OK. Finisih with fundamental. Lets look to the chart. What does it trying to tell us.

Zooming out, my reading of inverted Head & Shoulder still intact. However, Price is stuck at current resistance and pull back to previously RBS.

When we look into smaller scale - we can see the candle shows engulfing pattern, which is sign of reversal.

OK. That's it. Let's go hunting - on your preferred time frame.

#fcpo

#learnfcpo

#tradefcpo

1. 15.2.2016 - Last day for April Contract FCPO. Next active contract month is May.

2. ITS reported that export for 1-15 Feb 2016 was down by (16.11%) compared to 1-15 Jan 2016.

3. SGS reported that export for 1-15 Feb 2016 was down (14.16%)

OK. Finisih with fundamental. Lets look to the chart. What does it trying to tell us.

Zooming out, my reading of inverted Head & Shoulder still intact. However, Price is stuck at current resistance and pull back to previously RBS.

When we look into smaller scale - we can see the candle shows engulfing pattern, which is sign of reversal.

OK. That's it. Let's go hunting - on your preferred time frame.

#fcpo

#learnfcpo

#tradefcpo

Labels:

FCPO,

learn fcpo

Monday, February 8, 2016

Let's look onto Crude Chart (zoom out chart)

I guess, it is already oversold.

But market does whatever it wants (based on majority of position)

Lets look what will happen this time.

Fundamentally, Productions are still far over from demand line, thus it will rules the price.

Harga sedap nak produce minyak untuk kebanyakan producer - USD35/barrel. Lebih dari tu untung la.

I guess, it is already oversold.

But market does whatever it wants (based on majority of position)

Lets look what will happen this time.

Fundamentally, Productions are still far over from demand line, thus it will rules the price.

Harga sedap nak produce minyak untuk kebanyakan producer - USD35/barrel. Lebih dari tu untung la.

Labels:

crude oil

Subscribe to:

Posts (Atom)